Case Study: Royal Bank of Canada

Designing a new era of cash management system

Overview

Product Summary

Royal Bank of Canada’s Capital Markets organization took a bold new step into the future of cash management systems by building a brand new application from the ground up called RBC Clear. This product was the result of an empathetic approach that identified the key pain points and needs their large-scale enterprise-level customers were having.

This revolutionary cash management system required a high level of design leadership, strategy, and human-centered design skills to ensure its successful launch.

Business Objectives

Develop Competitive Cash Management System: Led the design and development of RBC Clear, a simplified cash management solution that tapped new revenue streams and delivered a standout customer experience.

Create Optimal User Experience: Orchestrated the user experience strategy for RBC Clear, contributing to the product winning 4 customer experience awards post-launch.

Result

Our team’s hands-on experience-led approach helped RBC obtain their business goals while building a product that its customers would benefit from and enjoy using. Following its launch, RBC Clear won 8 industry awards, including 2 for outstanding customer experience.

Tools

Figma, Jira, Mural

Role

My role within the RBC Clear project was to join as a thought leader for UX Design and Design Strategy while leading multiple value streams, including Developer Portal, Clear Connect, and Virtual Account Management.

Process Development

Redefining the Design Process

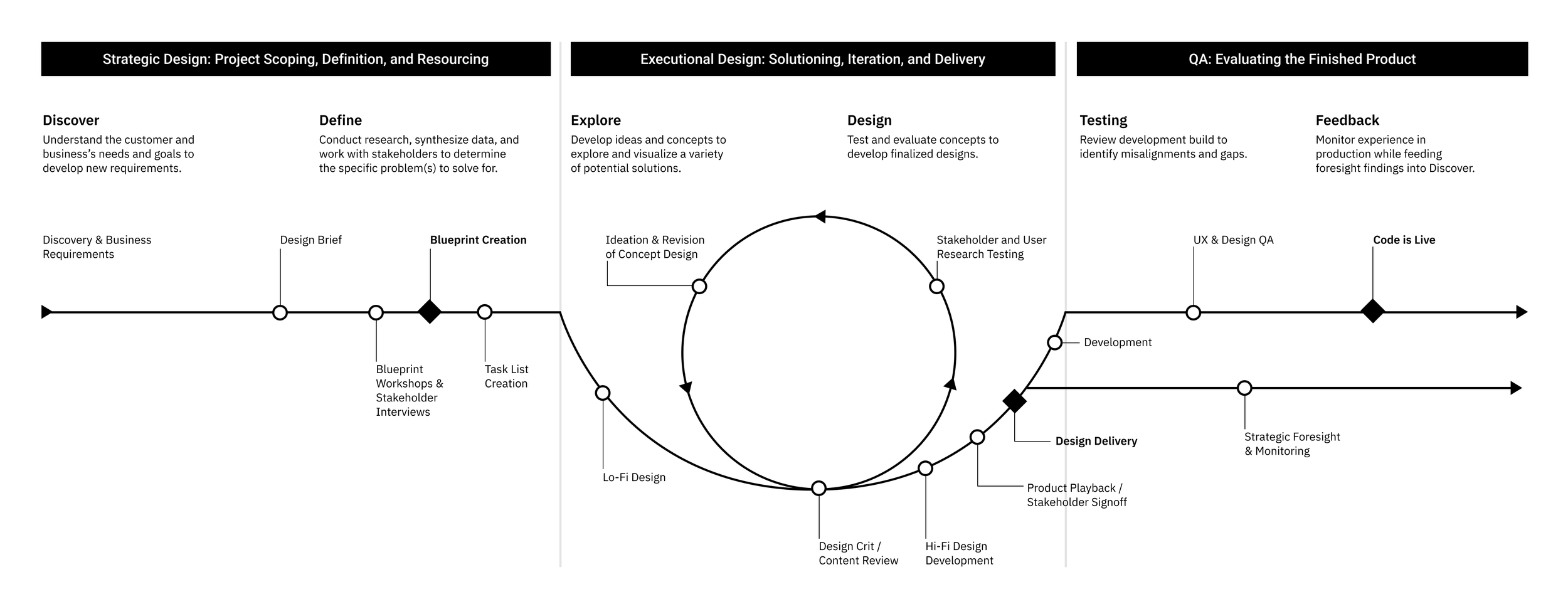

One of the challenges the team was facing when I first joined the project was a misalignment between product management and design. After investigating further I identified that one of the root causes of this issue was a lack of standardization in the end-to-end process from business requirement to design to development, in addition to an unclear understanding of how product management works with design.

To alleviate the issue, increase team efficiency, and improve collaboration with stakeholders I developed a standardized process that plugged into the already established service design approach. This new process involved:

Designers led workshop sessions with key stakeholders to develop a Service Design Blueprint.

Designers and Product Managers would review the completed blueprint to identify tasks and add them to a Task List.

The identified tasks were then mapped out by the Designer into Task Flow Diagrams and verified with stakeholders.

The Designer then used the diagrams to build Lo-Fi Designers which would be used for receiving direction approval from executive leaderships before creating and delivering Hi-Fi Designs.

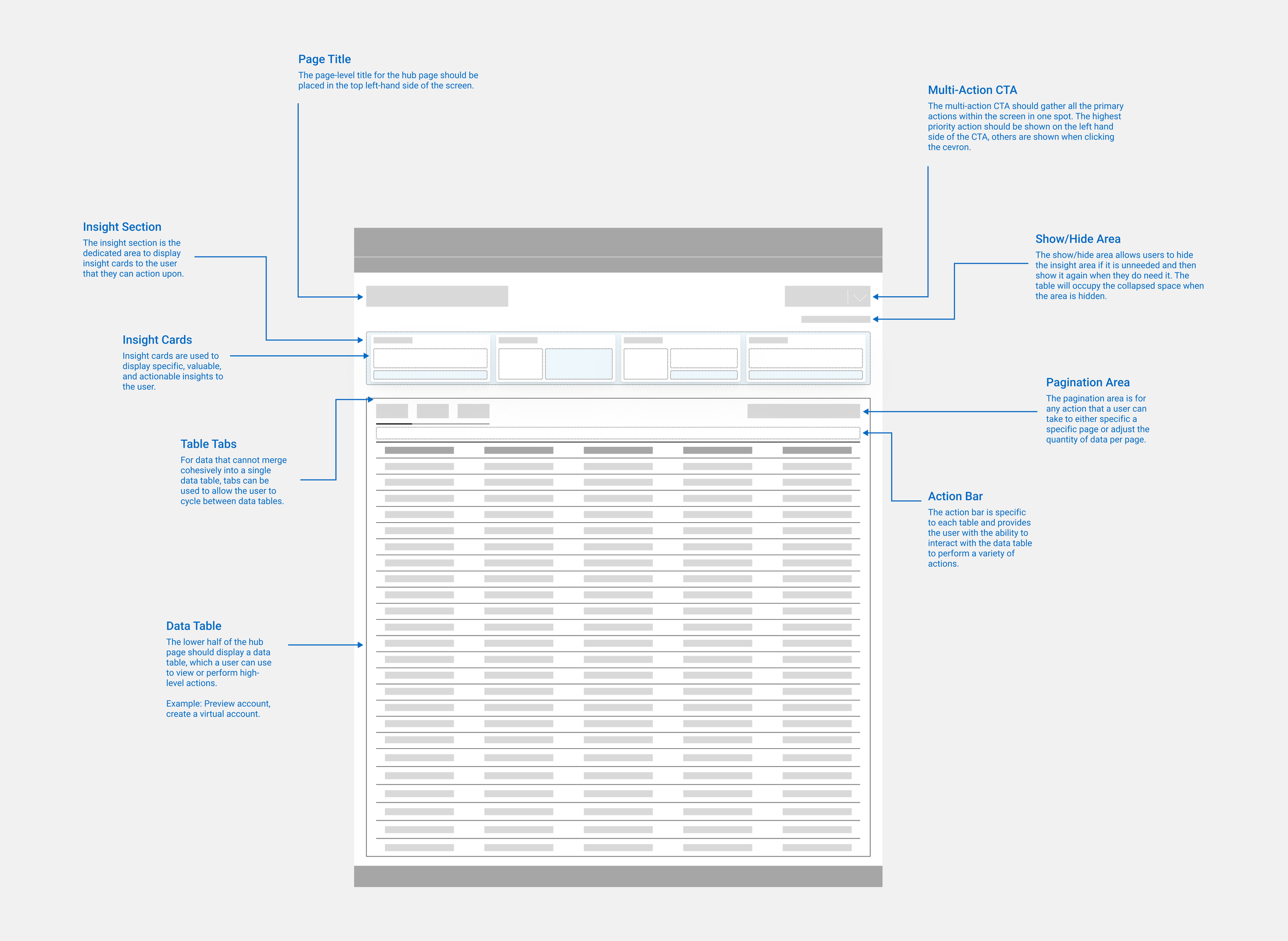

Task Flow and Lo-Fidelity Development

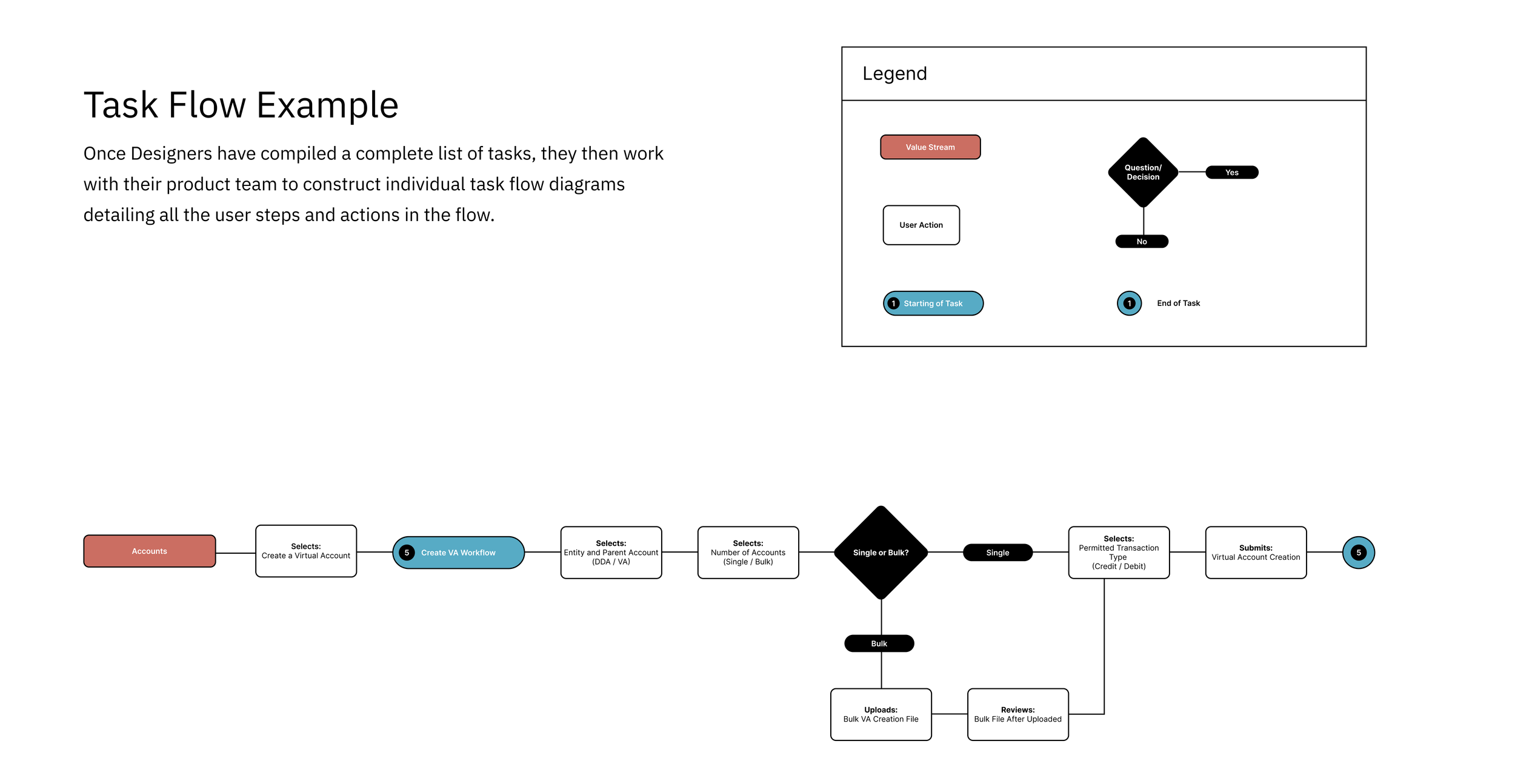

Developing a Task Flow template and standardization process was imperative to correcting some of the challenges that initially plagued the product team which was leading to a lot of rework as a result of missed requirements and understanding of the end-to-end flow. The task flows worked really well as they were easy for people familiar and unfamiliar with the value stream to understand the intent of the design while making it quick and simple to rework in real-time. The task flows were used through all levels of approval before moving into low-fidelity design development. Below is a shortened example of how a task flow looked like, in addition to its parts.

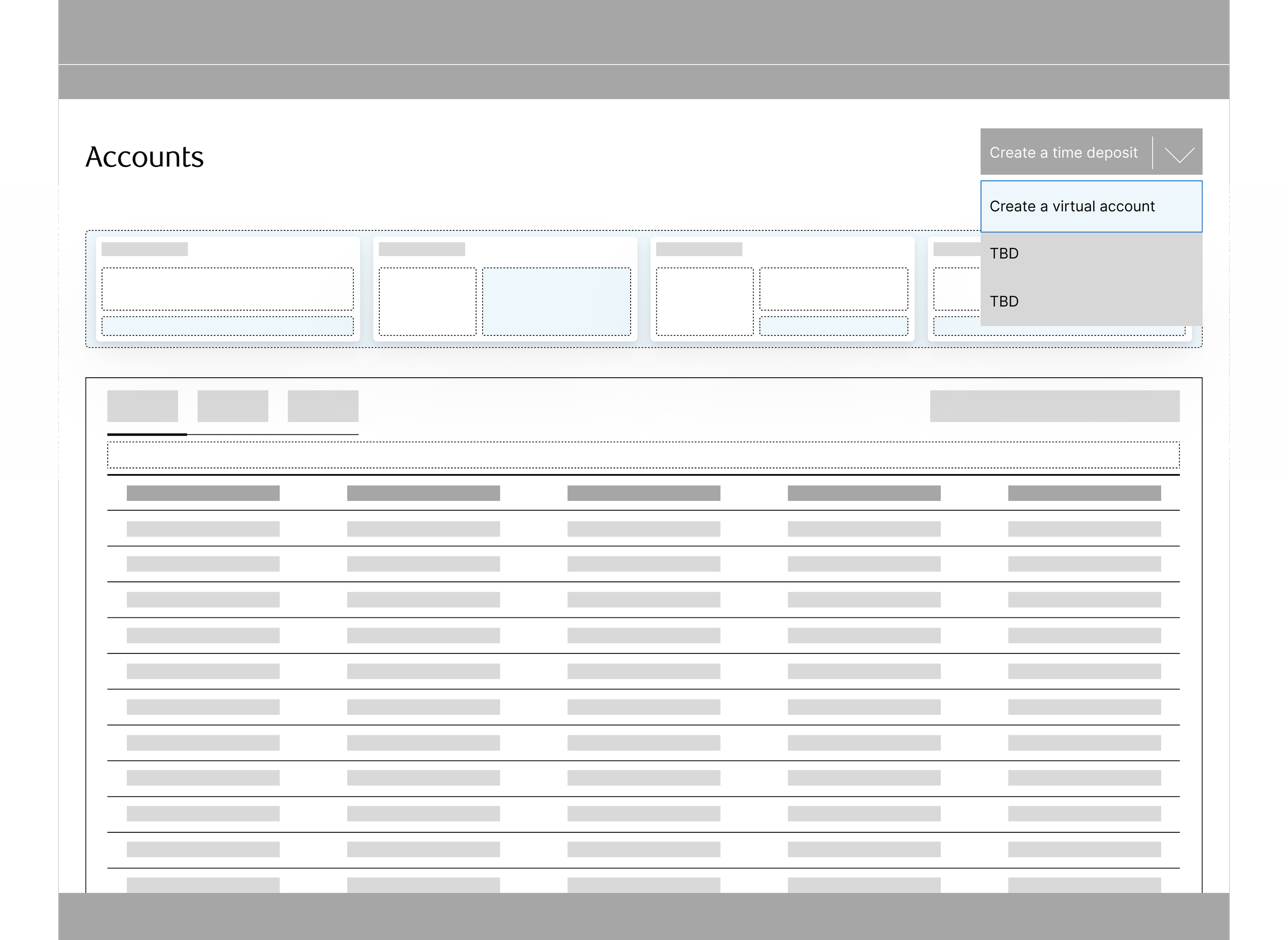

Following the approval of a task flow, designers would then work on the low-fidelity screens using the lo-fi design system I built to simplify their design process. The goal of the lo-fi design was to focus the conversation on the specific parts of the design that needed attention and make the experience the centre piece of the lo-fi prototypes. This equipped designers with the ability to get design feedback on the areas that were important for the experience and keep the conversation on topic with stakeholders.

Data Visualization Standardization

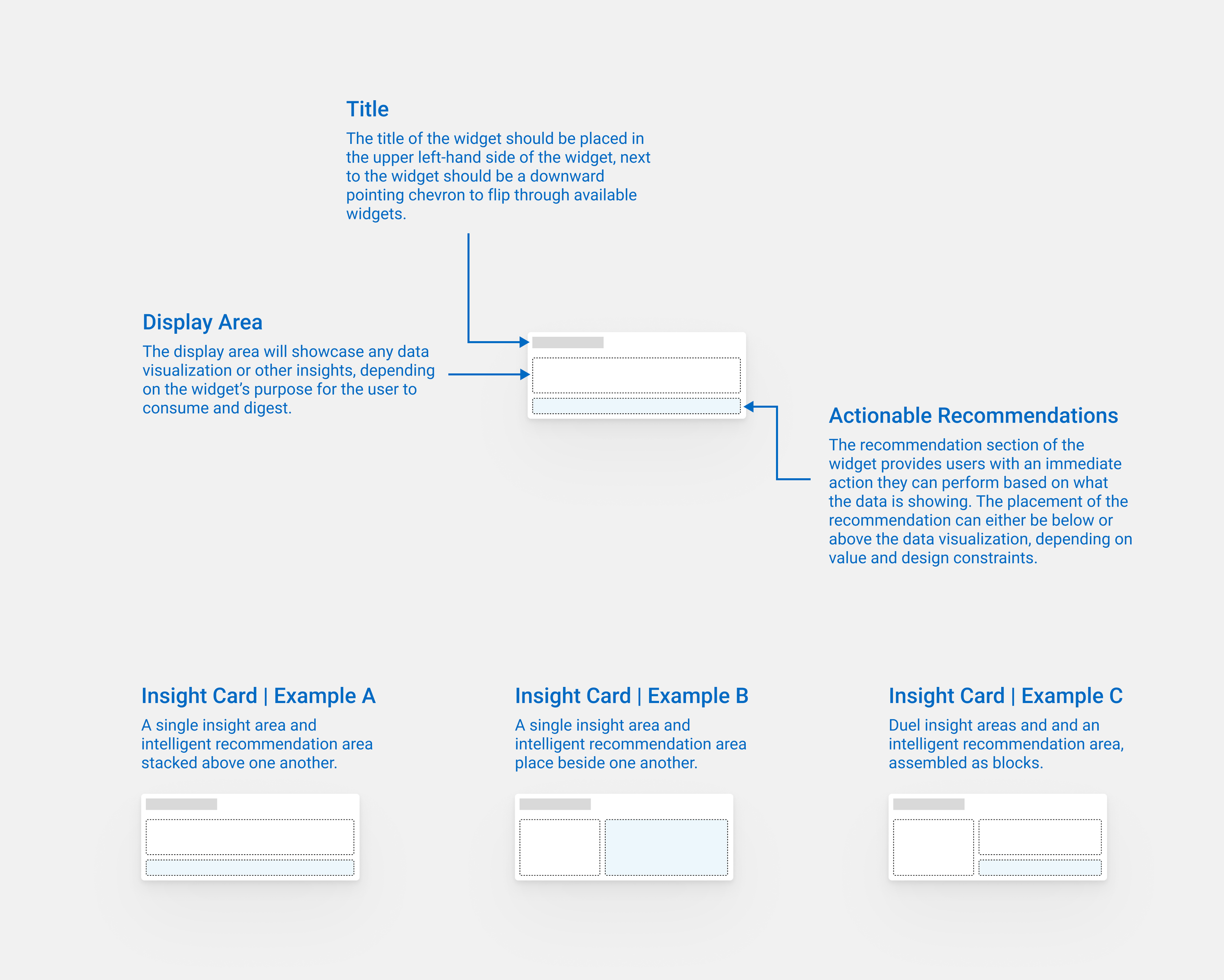

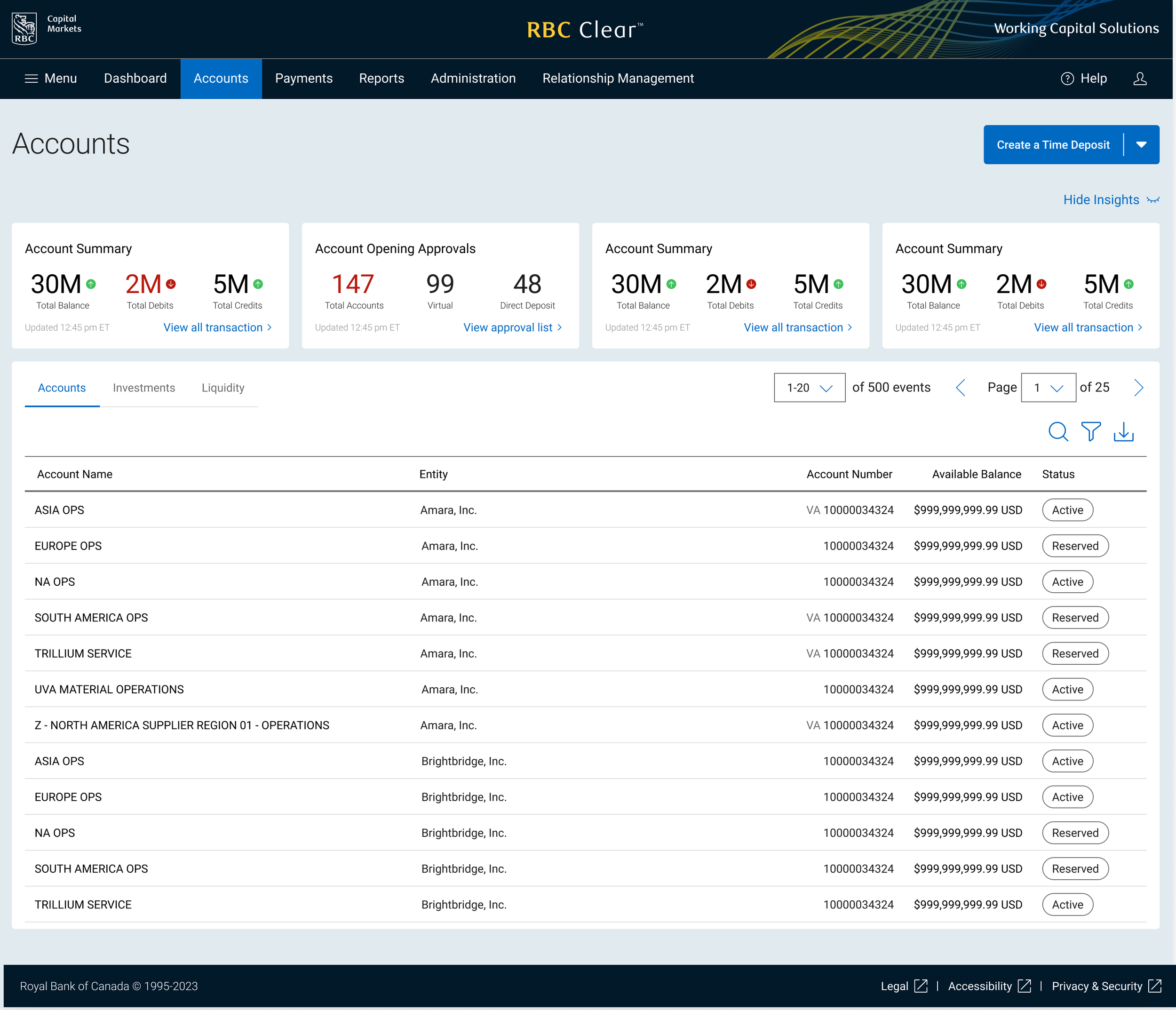

Once the screens began to mature into their high-fidelity designs, a need was vocalized by users asking for data visualization to be implemented throughout key areas of the platform. To do this we needed to develop a concept and standardized process which led to the development of the Insight Card. Unlike the Data Widgets, we proposed for future designs, Insight Cards are meant to be minimalist and only provide the user with three key pieces of information. This included the title, the display area, and actionable recommendations.

By keeping the insight cards minimal and focused, we were able to easily incorporate them into all our main section pages with minimum impact on the existing layout designs. We also provided users with the ability to hide the entire insight section if they weren’t currently using it.

Below is an example with test data that we used to demonstrate the capabilities of the insight cards. This current design is the MVP version as we planned to later on introduce visualizations like miniature bar charts, line graphs, etc.

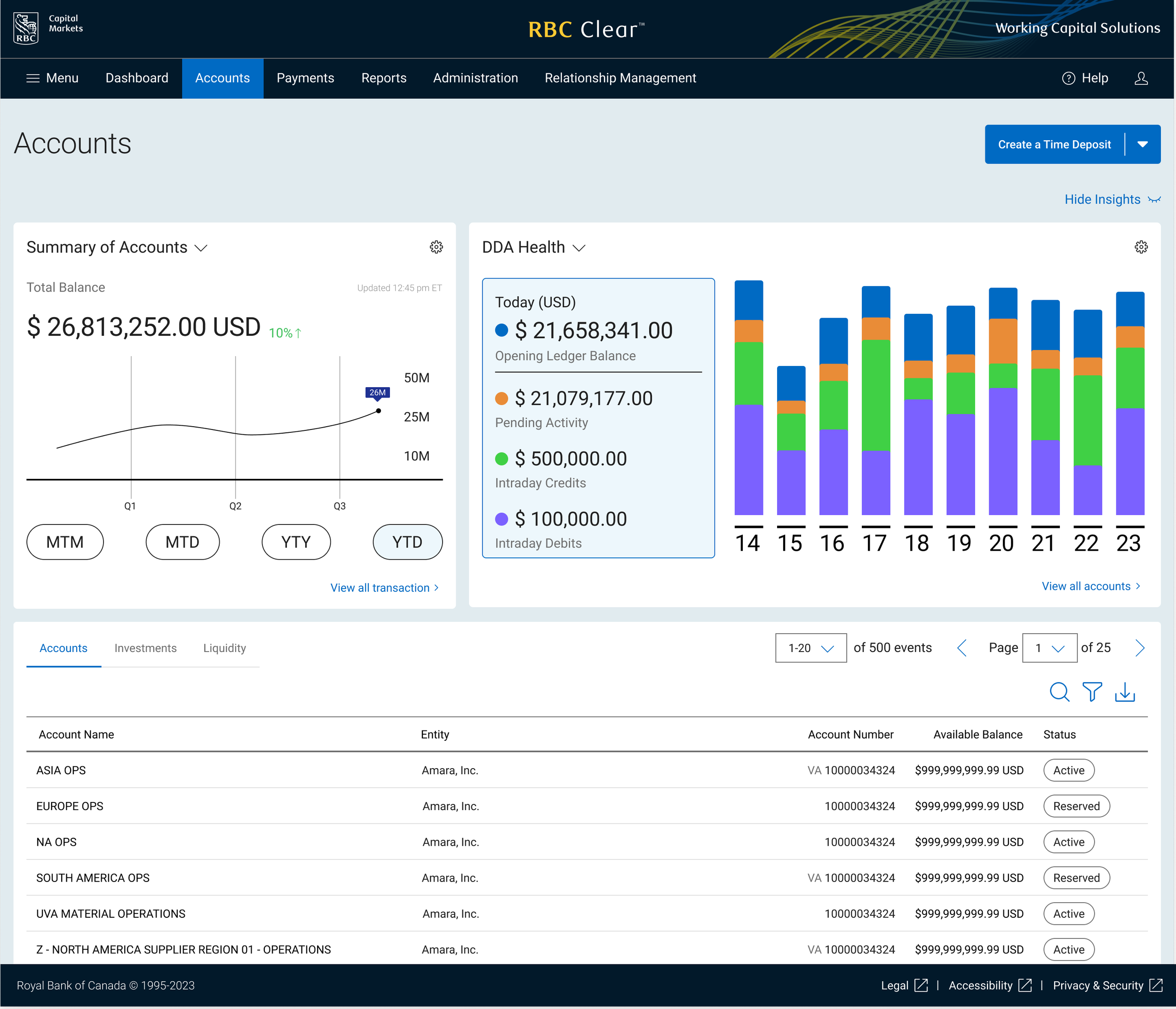

In addition to the insight cards, I developed the guidelines and concept designs for a future-looking implementation of Data Widgets. These widgets serve a different purpose than the insight cards as they are meant to provide the user with a lot more information while providing them the ability to manipulate how the data is shown to match their needs. Unfortunately, due to feasibility restraints, the widgets were pushed into the backlog for future development. Below you can see a brief concept draft that was created during the exploration phase.

Impact

Overall, the RBC Clear project was a success for our client and our design team. The new cash management system won eight awards including two for outstanding customer experience. Although the project ran into challenges at the beginning, by leveraging our collective design skills and my standardized design processes, we were able to persevere and ultimately lead the product team into building an experience that customers would find value in using for their businesses.